As the real estate market constantly fluctuates, the interplay between interest rates and housing affordability becomes a central point of discussion. Lower interest rates might seem like a beacon of hope for prospective homebuyers, but the reality is far more intricate. In this comprehensive analysis, we delve into the complexities behind the assumption that lower interest rates inevitably lead to improved housing affordability.

The reality for homeowners:

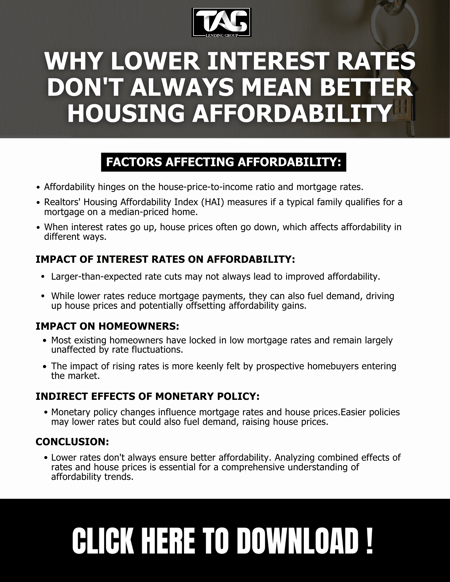

- Before diving into the complexities of housing affordability, it's crucial to acknowledge that most homeowners remain largely unaffected by fluctuations in interest rates. The majority locked in ultra-low mortgage rates before the recent hikes, shielding them from the brunt of rising costs. This aspect is often overlooked but is essential for understanding the broader picture.

- According to Black Knight McDash mortgage-servicing data, the annual home-purchasing rate hovers between 3 percent and 10 percent, indicating that the impact on the overall homeowner population is limited. Coupled with the fact that existing homeowners have already secured favorable rates, it becomes evident that the direct impact of interest rate changes on housing affordability extends primarily to prospective buyers rather than the broader homeowner demographic.

Measuring affordability:

- To gauge housing affordability accurately, we turn to the Realtors’ Housing Affordability Index (HAI), a comprehensive metric considering both mortgage rates and house prices. By dissecting this index, we gain insights into the multifaceted nature of affordability, where fluctuations in both variables significantly influence the housing landscape.

Quantifying the drivers of affordability:

- Delving deeper, it becomes apparent that the relationship between interest rates, house prices, and affordability is nuanced. While conventional wisdom suggests that lower rates should bolster affordability, empirical evidence paints a more complex picture. Charting the historical trajectory of housing affordability reveals the competing forces at play.

- Counterfactual analyses offer valuable insights by isolating the effects of interest rates and house prices on affordability. By fixing one variable while allowing the other to fluctuate, researchers can discern the individual contributions of each factor. Surprisingly, these analyses often debunk the myth that lower interest rates invariably lead to improved affordability, highlighting the need for a nuanced understanding of market dynamics.

Larger-than-expected rate cuts don’t always improve housing affordability:

- The influence of monetary policy on housing affordability cannot be overstated. While rate cuts are typically viewed favorably by prospective homebuyers, their impact on affordability is contingent upon various factors, including market conditions and consumer behavior. Charting the trajectory of housing affordability amidst monetary policy shifts reveals the intricate interplay between interest rates and house prices.

- Contrary to conventional wisdom, larger-than-expected rate cuts don't always translate to improved affordability. While lower rates may initially stimulate demand, they can also fuel upward pressure on house prices, offsetting any gains in affordability. This underscores the importance of considering the broader economic context when assessing the implications of monetary policy on the real estate market.

.png?width=1015&height=560&name=image%20(103).png)

Mortgage rates influence house prices:

- At the heart of the affordability conundrum lies the influence of mortgage rates on house prices. While changes in monetary policy directly impact borrowing costs, their indirect effects on housing demand and supply dynamics are equally significant. As mortgage rates fluctuate, they exert a ripple effect on the housing market, shaping both buyer behavior and seller expectations.

- Understanding the intricate relationship between mortgage rates and house prices is paramount for real estate professionals navigating today's dynamic market landscape. By recognizing the interplay between these variables, industry stakeholders can make informed decisions and anticipate market trends with greater precision.

Access Additional Resources

Our goal is to provide you, with all the tools you need to help your clients succeed on their homeownership journey. ✨

Unlocking Real Estate Success:

Tag Lending Group's Client Funnel Retention Program

In this dynamic video, we break down the essential components of our intake form and showcase how it empowers you to understand your return on investment, lead sources, and client demographics. Discover how we harness this data to fine-tune your marketing strategy and drive impressive results.🏠🔑

Follow us on Instagram for more

Boost your homeownership journey with exclusive tips, insights, and inspiration – follow us on Instagram! 🏠🔑

.png?width=262&height=339&name=Christina%20mosquera%20Loan%20Programs%20(1%25%20Giveback).png)

%20(1).png?width=262&height=339&name=Christina%20mosquera%20Loan%20Programs%20(1%25%20Giveback)%20(1).png)

.png?width=500&height=647&name=TLG%20FLYERS%20(4).png)